Breaking News

Popular News

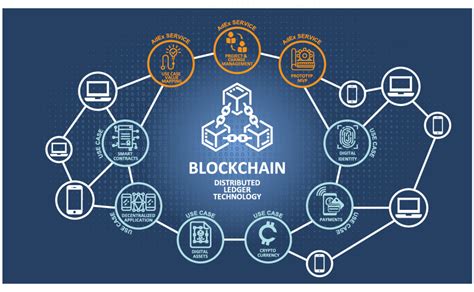

Learn about the role of blockchain in financial transactions, including its technology, implementation, security enhancements, cost reduction, transparency, accountability, and future challenges.In today’s digital age, the evolution of technology has significantly impacted the way financial transactions are conducted. One such technological innovation that has been making waves in the financial industry is blockchain. From its inception as the backbone of cryptocurrencies to its potential applications in various sectors, blockchain technology has shown great promise in revolutionizing financial transactions. In this blog post, we will explore the role of blockchain in financial transactions by delving into its underlying technology, its implementation in financial systems, the enhancement of security, the reduction of transaction costs, and the improvement of transparency and accountability. Additionally, we will also discuss the challenges and the future of blockchain in finance. By the end of this post, you will have a deeper understanding of how blockchain is reshaping the way we think about and conduct financial transactions.

Contents

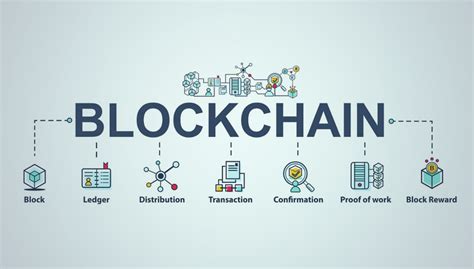

Blockchain technology is a revolutionary concept that is changing the way we think about financial transactions. It is a decentralized, distributed ledger that records transactions across multiple computers, creating a secure and transparent network. Unlike traditional centralized systems, blockchain allows for peer-to-peer transactions without the need for a trusted intermediary.

One of the key features of blockchain is its immutability, meaning that once a transaction is recorded on the ledger, it cannot be altered or deleted. This provides a high level of security and trust in the financial system, reducing the risk of fraud and tampering. Additionally, blockchain uses advanced cryptographic techniques to ensure that transactions are secure and private.

Furthermore, blockchain technology has the potential to improve efficiency and reduce costs in financial transactions. By eliminating the need for intermediaries and streamlining the transaction process, blockchain can significantly reduce the time and resources required for financial transactions.

In conclusion, understanding blockchain technology is essential for anyone involved in financial transactions. Its decentralized nature, immutability, and potential for efficiency make it an important innovation in the financial industry.

The implementation of blockchain technology in financial systems is revolutionizing the way transactions are conducted. By utilizing a decentralized and distributed ledger, financial institutions can improve the efficiency, security, and transparency of their transactions. One way in which blockchain is being implemented is through the use of smart contracts, which automate and enforce the terms of an agreement. This eliminates the need for intermediaries and reduces the risk of fraud.

Furthermore, the use of blockchain technology can help to reduce transaction costs by streamlining the process and eliminating the need for multiple parties to verify and authorize transactions. This not only saves time but also reduces the fees associated with traditional financial transactions. In addition, blockchain technology can improve the speed at which transactions are processed, allowing for near-instantaneous transfers of funds.

By implementing blockchain in financial systems, institutions can also enhance security by creating a permanent and unchangeable record of transactions. This helps to prevent fraud and unauthorized access to sensitive financial information. In addition, the use of blockchain can improve transparency and accountability, as all transactions are recorded on a public ledger that can be accessed by anyone.

| Advantages of Implementing Blockchain in Financial Systems |

|---|

| Improved efficiency, security, and transparency |

| Reduction of transaction costs |

| Automated and enforceable smart contracts |

| Enhanced speed of transactions |

Blockchain technology plays a crucial role in enhancing security in financial transactions. By utilizing a decentralized and immutable ledger, blockchain ensures that each transaction is secure and tamper-proof. The use of cryptographic techniques and consensus mechanisms further adds a layer of security, making it extremely difficult for unauthorized parties to manipulate or alter financial data.

Additionally, blockchain technology implements smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This ensures that financial transactions are automatically executed when predefined conditions are met, eliminating the need for intermediaries and reducing the risk of human error or fraud.

Moreover, the transparent nature of blockchain allows financial transactions to be securely recorded and verified in real time. This level of transparency provides greater visibility into financial activities, allowing for improved fraud detection and prevention. With each transaction being recorded on a distributed network, the risk of a single point of failure or data breach is significantly reduced, further enhancing security in financial transactions.

| Advantages | Challenges |

|---|---|

|

|

In today’s fast-paced financial world, transaction costs can add up quickly. Whether it’s fees for international money transfers or charges for processing credit card payments, these costs can significantly impact businesses and consumers alike. However, Blockchain technology has the potential to revolutionize the way financial transactions are conducted, ultimately leading to a reduction in transaction costs.

One of the key ways in which Blockchain reduces transaction costs is by eliminating the need for intermediaries. Traditionally, financial transactions require third-party intermediaries such as banks or payment processors to verify and process the transactions, which comes with additional fees. With Blockchain, transactions are verified and recorded in a decentralized and shared ledger, removing the need for costly intermediaries.

Moreover, the use of smart contracts in Blockchain technology can further reduce transaction costs by automating and streamlining the execution of contracts and agreements. By eliminating the need for manual processing and verification, smart contracts can significantly reduce the time and resources required to complete transactions, therefore cutting down on associated costs.

| Traditional Transaction System | Blockchain-based Transaction System |

|---|---|

| Relies on intermediaries for verification and processing | Decentralized verification and recording of transactions |

| Manual contract execution and verification | Automated and streamlined execution through smart contracts |

Overall, the adoption of Blockchain technology in financial transactions has the potential to significantly reduce transaction costs for businesses and consumers, while also streamlining and enhancing the security of transactions. As the technology continues to mature and gain widespread acceptance, we can expect to see a further reduction in transaction costs across various financial sectors.

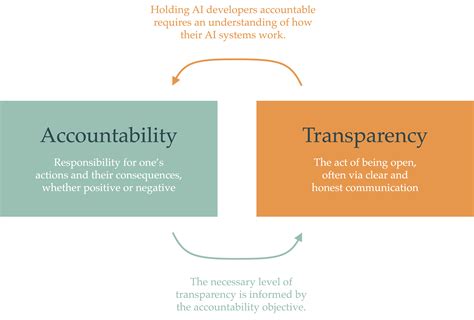

Blockchain technology has the potential to revolutionize the way financial transactions are conducted by improving transparency and accountability. Unlike traditional financial systems, blockchain provides a decentralized and immutable ledger that records every transaction. Each transaction is verified by a network of nodes, making it virtually impossible to alter or manipulate. This level of transparency ensures that all parties involved in a transaction can easily verify its authenticity, promoting trust and accountability within the financial system.

Furthermore, the use of smart contracts in blockchain technology can further enhance transparency and accountability in financial transactions. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Once these terms are met, the contract is automatically enforced, eliminating the need for intermediaries and reducing the potential for error or fraud. This streamlined process not only improves the efficiency of financial transactions but also ensures that all parties adhere to the agreed-upon terms, promoting greater transparency and accountability.

Moreover, the use of blockchain in financial transactions can reduce the risk of fraud and corruption. By recording every transaction on a tamper-proof ledger, blockchain technology makes it incredibly difficult for malicious actors to engage in fraudulent activities. This increased level of security and transparency can help prevent financial crimes, such as money laundering and embezzlement, ultimately promoting greater accountability within the financial sector.

In conclusion, the implementation of blockchain technology in financial transactions has the potential to significantly improve transparency and accountability within the financial system. Through its decentralized and immutable nature, smart contract capabilities, and enhanced security features, blockchain technology can help build trust and foster a greater sense of accountability among all parties involved in financial transactions.

Implementing blockchain technology in the financial industry comes with its own set of challenges. One of the main challenges is the lack of regulatory framework and standardization. With each country having its own set of rules and regulations, it becomes difficult for financial institutions to adopt blockchain in a uniform manner. This lack of standardization also leads to uncertainty and risk, making it hard for organizations to fully trust and invest in this technology.

Another challenge is the issue of scalability. As the number of transactions increases, the blockchain network can become slow and congested. This can lead to delays and high transaction costs, making it less attractive for financial transactions. Finding a way to improve the scalability of blockchain without compromising its security and decentralization is crucial for its future in finance.

Looking towards the future, the potential of blockchain in finance is vast. With continued development and innovation, blockchain has the power to revolutionize the financial industry by improving transparency, security, and efficiency. As more organizations and institutions start to adopt and invest in blockchain, the technology is likely to become more mainstream, paving the way for a more secure and streamlined financial ecosystem.

Despite the challenges, the future of blockchain in finance looks promising. As the technology continues to mature and evolve, it has the potential to address many of the existing issues in the financial sector, providing a foundation for a more secure, transparent, and efficient financial system.

What is blockchain technology?

Blockchain is a decentralized, distributed ledger that records transactions across many computers in such a way that the registered transactions cannot be altered retroactively.

How does blockchain ensure security in financial transactions?

Blockchain ensures security through the use of cryptographic techniques which makes it nearly impossible to tamper with the data stored in the blockchain.

What are the benefits of using blockchain in financial transactions?

Some of the benefits include transparency, reduced costs, increased efficiency, and enhanced security.

What are some examples of financial transactions that can benefit from blockchain technology?

Examples include cross-border payments, trade finance, and supply chain finance.

What are the potential challenges in adopting blockchain for financial transactions?

Challenges may include regulatory uncertainty, interoperability issues, and concerns about scalability.

How can blockchain improve the speed of financial transactions?

Blockchain can improve speed by eliminating the need for intermediaries and streamlining the process of verification and settlement.

What is the future outlook for blockchain in financial transactions?

The future looks promising as more industries and financial institutions are exploring the potential of blockchain to revolutionize the way transactions are conducted.